does kansas have an estate or inheritance tax

However the federal estate tax exemption was recently raised to a threshold of 112 million for an individual and double this amount for a couple. Unlike an inheritance tax New York does have an estate tax.

Taxes Archives Skloff Financial Group

Property Taxes and Property Tax Rates Property Tax Rates In Kansas property taxes are set at the local level.

. The state sales tax rate is 65. The fact that oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they. Individuals should also file state and federal.

In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. DOES NOT HAVE Estate Tax Inheritance Tax State Income Tax Sales Tax STATE Alabama X X 400 Alaska X X X 000 Arizona X X 560 Arkansas X X 650 California X X 725 Colorado X X. The state of Kansas does not place a tax on estates or inheritances.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Capital Gains Taxes Capital gains are taxed as. However if you receive an inheritance from another state you may be.

Hi does kansas have an inheritance tax. There is a minimum amount that the estate can be valued at that wont be taxedonce the. The ohio estate tax was repealed.

Does Kansas Have an Inheritance or Estate Tax. The state sales tax rate is 65. 1 day agoMany of the states with the largest economies like California and Texas do have an estate or inheritance tax.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Unlike an inheritance tax New York does have an estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

State Tax Rate Estate Size. The sales tax rate in Kansas is 65. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets.

As a result wealthy entrepreneurs may pass. Many cities and counties impose their. New Yorks estate tax.

These states have an inheritance tax.

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Kansas Living Magazine

State By State Estate And Inheritance Tax Rates Everplans

:max_bytes(150000):strip_icc()/GettyImages-160577316-589600965f9b5874ee19d2b6.jpg)

The Difference Between Estate Taxes And Inheritance Taxes

Fillable Online Kansas Inheritance Tax Return Fax Email Print Pdffiller

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

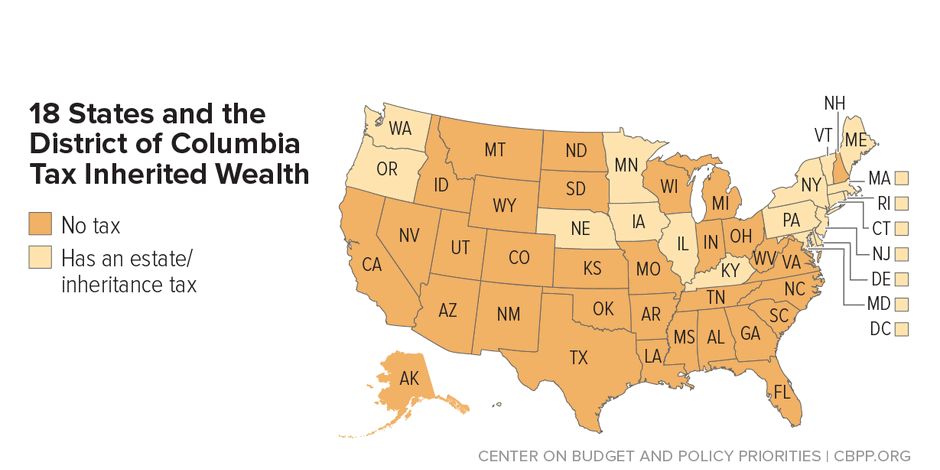

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

Blog Graber Johnson Law Group Llc

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

State Estate And Inheritance Taxes Itep

Estate Tax Law Changes What To Do Now

How Much Is Inheritance Tax Probate Advance

What Is Inheritance Tax Probate Advance

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Does Your State Have An Estate Or Inheritance Tax

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Estate Planning Lawyer In Wichita Explains Estate Tax Portability

State Taxes On Inherited Wealth Center On Budget And Policy Priorities